Heartwarming Info About How To Apply For A Fein

Internal revenue service uses these numbers to:

How to apply for a fein. Every corporation, partnership, and most llcs must apply for and receive an employer identification number (ein) from the internal revenue service (irs). Once the application is completed, the information is validated during the online session, and an ein is issued immediately. Applying is free and only takes a few minutes online at irs.gov.

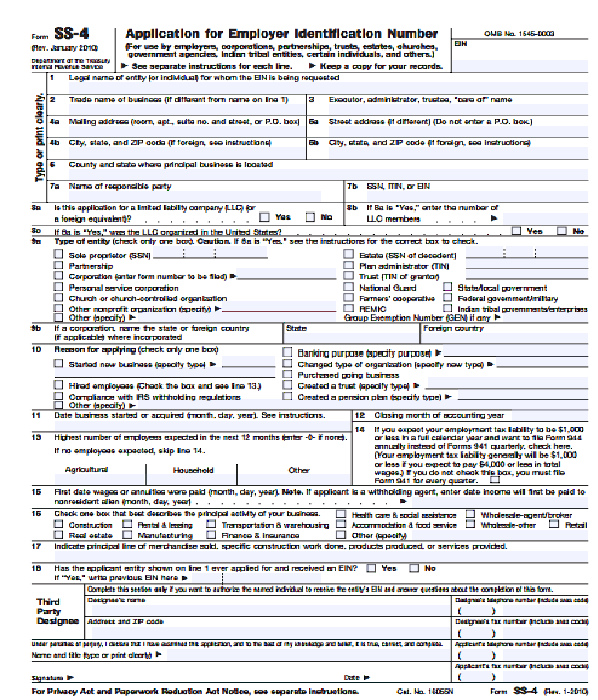

All forms of businesses can apply for and be issued eins, including: A detailed guide for the federal employer identification number. Your business is a corporation or partnership.

You'll need to provide accurate information about your business structure, the responsible party, and the nature of your business activities. You may also apply by telephone if your organization was formed outside the u.s. Apply for an ein online—if you fill out the ein online application, you can get your tax id number.

Your principal business, office, or legal residence is in the u.s. Who is a responsible party? The site will validate your information and issue the ein immediately.

Applying for a fein involves a clear process accessible through the irs website. To use the online application, the following must be true: You may apply for an ein online if your principal business is located in the united states or u.s.

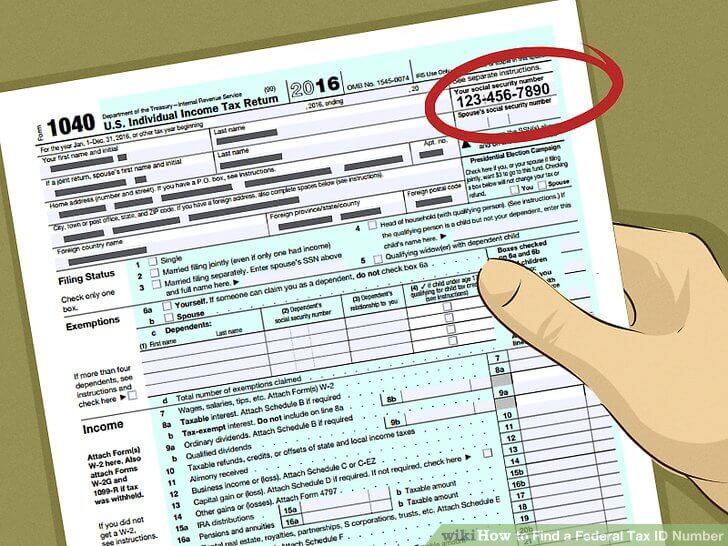

Four steps to fulfilling the online application process as follows. A federal tax id number is also known as a federal employer identification number, also called an ein or fein. It is also known as a federal tax.

An fein is the identifying number that the federal internal revenue service (irs) uses to identify a business based on. Identify businesses located in the united states and its territories. How long will it take to get a number?

Complete the application with your information and submit. Former sinn fein president gerry adams. When do employers need to change their fein?

The time frame to get an ein varies depending on how you apply. Does my llc need an ein? The irs processes online ein applications immediately.

You can apply for an ein online, by mail, or by fax. How to apply for an ein. This is the fastest way to get your ein.